Maximor get $9m for AI that takes on finance grunt work while keeping it BAU

Finance teams using Maximor report ~40% more capacity for strategic work, faster closes, and cleaner audits.

New York, Sept. 29, 2025 (GLOBE NEWSWIRE) -- Finance leaders know they should be spending more time guiding business decisions, yet their teams spend most of their time shuffling data between systems and fixing spreadsheets. Maximor wants to change that. The company today announced a $9 million seed round to expand its finance automation platform — AI agents that plug into ERPs, payroll, billing, and bank systems to take on the repetitive accounting work and produce audit-ready outputs by default.

The round was led by Foundation Capital, with participation from Gaia Ventures (founded by SAP’s former Chief Strategy Officer) and Boldcap. Notable angels include Aravind Srinivas (CEO of Perplexity), Tien Tzuo (CEO of Zuora), and CFOs/finance leaders from Ramp, Gusto, Opendoor, MongoDB, and the Big Four.

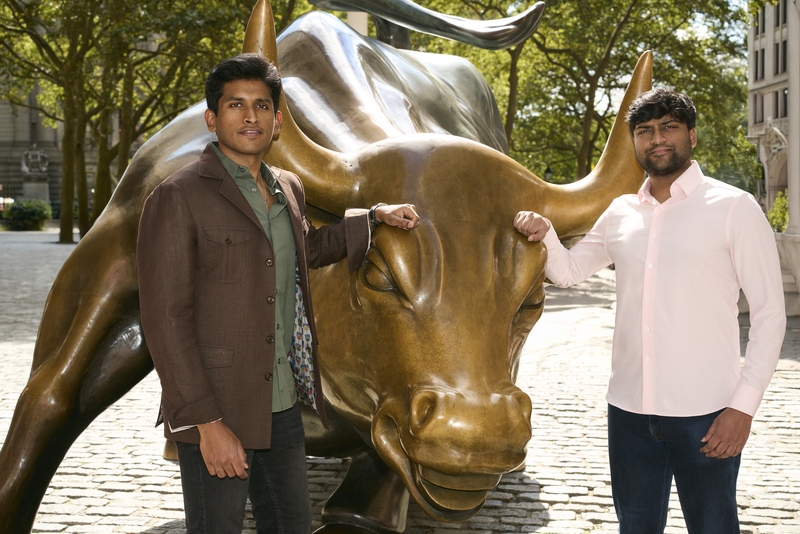

Maximor AI founders: Ramnandan Krishnamurthy and Ajay Krishna Amudan.

Finance leaders today face a paradox: they’re expected to steer strategy while their teams are buried in reconciliations, close checklists, and fragmented systems. The talent pipeline of accountants is also at a breaking point—three-quarters of accountants are expected to retire by 2030, while fewer graduates enter the field. That leaves companies stretched thin, raising the odds of costly errors and slowing down audits.

Across its customer base, Maximor has delivered three strategic outcomes: ~40% more team capacity, freeing finance staff to focus on strategy, not mechanics, Cleaner audits and streamlined closes, reducing compliance and valuation risk; and Unified, cross-silo visibility across existing finance & operational systems – so finance leaders can make faster, better-informed decisions with AI’s reasoning capabilities

Proptech business Rently, with global operations across three countries, cut its month-end close from 8 days to 4 within the first month of using Maximor, while avoiding two incremental accounting hires for repetitive work. While, multi-billion-dollar AUM registered investment advisor business Invst was able to automate reconciliations, allocations, and reporting, unlocking advisor-level profitability insights that were previously impractical.

Maximor is not another point solution. It is a financial command center that connects both financial and operational systems—ERPs like NetSuite and Intacct, banks, payroll, CRMs, and SaaS data—into a single reconciled source of truth.

On this unified data foundation, Maximor deploys specialized finance agents across revenue, cash, close, and reporting. Powered by its proprietary Audit-Ready Agent™ architecture, these agents generate workpapers, reviewer notes, and audit trails by default. The result: automation that is natively explainable, compliant, secure and enterprise-grade—tailored to the exacting needs of the CFO’s office.

“Finance should be the growth engine of a company, not a cost center,” said Ramnandan Krishnamurthy, CEO and co-founder of Maximor. “Capital is how decisions are made. Our job is to automate the mechanics and unify the data so finance leaders can spend time guiding the business. We measure success by customer outcomes, not seats purchased.”

Co-founders Ramnandan Krishnamurthy and Ajay Krishna Amudan saw the problem firsthand while leading Microsoft’s digital transformation group and working with global corporate finance teams: despite millions poured into ERPs and accounting tools, technical limitations forced critical workflows back into spreadsheets—creating endless manual work, slow closes, and costly errors.

"What attracted us to Maximor is their seamless integration to any ERP system. Instead of chasing features like many ERP startups, Maximor uses AI to tackle real challenges faced by finance leaders at global companies," said Ashu Garg, General Partner at Foundation Capital. "Unlike solutions with disconnected AI tools, Maximor has built a unified platform where specialized AI agents work together seamlessly. For mid-market and enterprise finance teams, it bridges the gap between their current systems and advanced AI, enabling meaningful transformation without disruption."

“Finance should be a growth catalyst, not a bottleneck. With Maximor, our team delivers reliable, audit-ready outputs efficiently while freeing up nearly 50% of our capacity for strategic work. I’m excited about the doors this opens for our business—and energized to partner with a team that’s both world-class and customer-focused.” said Dustin Neal, CFO at Rently (Maximor customer).

Maximor’s design philosophy, “Design for Progress” reflects its commitment to helping finance leaders build financially progressive companies: outcome-assured automation adapted to each organization’s finance ops style, not a one-size-fits-all template.

Over the last two decades, financial software has over-promised and under-delivered, fragmenting workflows across point tools with no intelligence baked in. Unlike point tools that automate fragments, Maximor is the only platform built to automate finance processes end-to-end—“cradle to grave”—with enterprise-grade control. It uniquely combines a unified finance context layer with a specialized system of agents, powered by its Audit-Ready Agent™ architecture - delivering CFOs automation with evidence, not just speed.

Maximor is expanding in three directions: Deeper automation across the breadth of repetitive accounting flows, Vertical modules tailored for specific sectors with high urgency to adopt; and Strategic finance insights that move teams from reactive reporting to proactive scenario planning and decision support. The vision: an always-on, audit-ready AI-powered finance team for every mid-market and enterprise company.

Media images can be found here.

About Maximor

Maximor is an ERP-agnostic, AI-native finance automation platform for mid-market and enterprise companies. By unifying financial and operational data and deploying a system of specialized finance agents powered by proprietary Audit-Ready Agent™ architecture, it automates revenue, cash, close, and reporting processes with audit-ready evidence by default. Finance teams close faster, reduce manual reconciliations, and unlock deeper operating insight—without migrating off their existing stack. Maximor is backed by Foundation Capital, Gaia Ventures, Boldcap, and leading industry operators. Learn more at maximor.ai.

For further information please contact the Maximor press office on press@maximor.ai

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.